Advertisement

-

Published Date

October 11, 2021This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

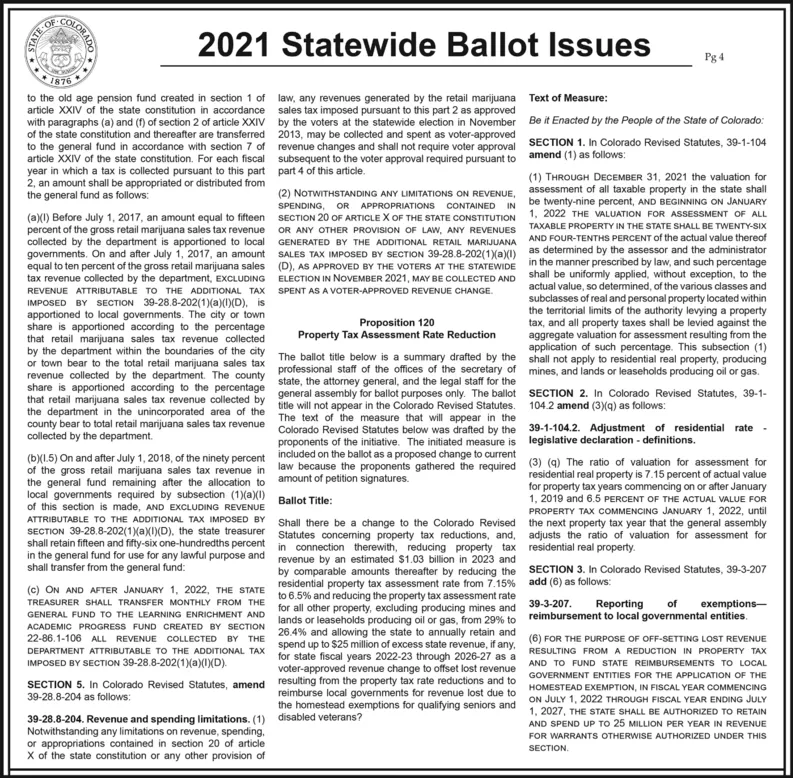

2021 Statewide Ballot Issues Pg 4 1876 to the old age pension fund created in section 1 of law, any revenues generated by the retail marijuana Text of Measure: article XXIV of the state constitution in accordance sales tax imposed pursuant to this part 2 as approved with paragraphs (a) and (f) of section 2 of article XXIVV by the voters at the statewide election in November Be it Enacted by the People of the State of Colorado: of the state constitution and thereafter are transferred 2013, may be collected and spent as voter-approved to the general fund in accordance with section 7 of revenue changes and shall not require voter approval SECTION 1. In Colorado Revised Statutes, 39-1-104 article XXIV of the state constitution. For each fiscal subsequent to the voter approval required pursuant to year in which a tax is collected pursuant to this part part 4 of this article. 2, an amount shall be appropriated or distributed from the general fund as follows: amend (1) as follows: (1) THROUGH DECEMBER 31, 2021 the valuation for (2) NOTWITHSTANDING ANY LIMITATIONS ON REVENUE, assessment of all taxable property in the state shall be twenty-nine percent, AND BEGINNING ON JANUARY SPENDING, OR APPROPRIATIONS CONTAINED IN 1, 2022 THE VALUATION FOR ASSESSMENT OF ALL (a)(I) Before July 1, 2017, an amount equal to fifteen SECTION 20 OF ARTICLE X OF THE STATE CONSTITUTION percent of the gross retail marijuana sales tax revenue collected by the department is apportioned to local governments. On and after July 1, 2017, an amount equal to ten percent of the gross retail marijuana sales (D), AS APPROVED BY THE VOTERS AT THE STATEWIDE tax revenue collected by the department, EXCLUDING ELECTION IN NOVEMBER 2021, MAY BE COLLECTED AND TAXABLE PROPERTY IN THE STATE SHALL BE TWENTY-SIX OR ANY OTHER PROVISION OF LAW, ANY REVENUES AND FOUR-TENTHS PERCENT of the actual value thereof GENERATED BY THE ADDITIONAL RETAIL MARIJUANA SALES TAX IMPOSED BY SECTION 39-28.8-202(1(a)(1) as determined by the assessor and the administrator in the manner prescribed by law, and such percentage shall be uniformly applied, without exception, to the actual value, so determined, of the various classes and subclasses of real and personal property located within the territorial limits of the authority levying a property tax, and all property taxes shall be levied against the aggregate valuation for assessment resulting from the application of such percentage. This subsection (1) REVENUE ATTRIBUTABLE TO THE ADDITIONAL TAX SPENT AS A VOTER-APPROVED REVENUE CHANGE. IMPOSED BY SECTION 39-28.8-202(1)(a)(1)(D), is apportioned to local governments. The city or town share is apportioned according to the percentage that retail marijuana sales tax revenue collected by the department within the boundaries of the city or town bear to the total retail marijuana sales tax The ballot tide below is a summary drafrted by the shall not apply to residential real property, producing revenue collected by the department. The county professional staff of the offices of the secretary of mines, and lands or leaseholds producing oil or gas. share is apportioned according to the percentage general assembly for ballot purposes only. The ballot SECTION 2. In Colorado Revised Statutes, 39-1- that retail marijuana sales tax revenue collected by itle will not appear in the Colorado Revised Statutes. 104.2 amend (3)(q) as follows: the department in the unincorporated area of the county bear to total retail marijuana sales tax revenue collected by the department. Proposition 120 Property Tax Assessment Rate Reduction state, the attorney general, and the legal staff for the The text of the measure that will appear in the Colorado Revised Statutes below was drafted by the 39-1-104.2. Adjustment of residential rate- proponents of the initiative. The initiated measure is legislative declaration - definitions. (b)XL.5) On and after July 1, 2018, of the ninety percent included on the ballot as a proposed change to current of the gross retail marijuana sales tax revenue in law because the proponents gathered the required (3) (q) The ratio of valuation for assessment for the general fund remaining after the allocation to amount of petition signatures. local governments required by subsection (1)(a)(1) Ballot Title: of this section is made, AND EXCLUDING REVENUE residential real property is 7.15 percent of actual value for property tax years commencing on or after January 1, 2019 and 6.5 PERCENT OF THE ACTUAL VALUE FOR PROPERTY TAX COMMENCING JANUARY 1, 2022, until Shall there be a change to the Colorado Revised the next property tax year that the general assembly Statutes concerming property tax reductions, and, adjusts the ratio of valuation for assessment for ATTRIBUTABLE TO THE ADDITIONAL TAX IMPOSED BY SECTION 39-28.8-202(1)(aXI)(D). the state treasurer shall retain fifteen and fifty-six one-hundredths percent in connection therewith, reducing property tax residential real property. in the general fund for use for any lawful purpose and revenue by an estimated $1.03 billion in 2023 and shall transfer from the general fund: by comparable amounts thereafter by reducing the SECTION 3. In Colorado Revised Statutes, 39-3-207 residential property tax assessment rate from 7.15% add (6) as follows: to 6.5% and reducing the property tax assessment rate for all other property, excluding producing mines and lands or leaseholds producing oil or gas, from 29% to reimbursement to local governmental entities. 26.4% and allowing the state to annually retain and (c) ON AND AFTER JANUARY 1, 2022, THE STATE TREASURER SHALL TRANSFER MONTHLY FROM THE 39-3-207. Reporting of exemptions- GENERAL FUND TO THE LEARNING ENRICHMENT AND ACADEMIC PROGRESS FUND CREATED BY SECTION DEPARTMENT ATTRIBUTABLE TO THE ADDITIONAL TAX Spend up to $25 million of excess state revenue, if any, (0) FOR THE PURPOSE OF OFF-SETTING LOST REVENUE for state fiscal years 2022-23 through 2026-27 as a 22-86.1-106 ALL REVENUE COLLECTED BY THE RESULTING FROM A REDUCTION IN PROPERTY TAX IMPOSED BY SECTION 39-28.8-202(1(a)(1)(D). AND TO FUND STATE REIMBURSEMENTS TO LOCAL voter-approved revenue change to offset lost revenue GOVERNMENT ENTITIES FOR THE APPLICATION OF THE SECTION 5. In Colorado Revised Statutes, amend resulting from the property tax rate reductions and to 39-28.8-204 as follows: reimburse local governments for revenue lost due to HOMESTEAD EXEMPTION, IN FISCAL YEAR COMMENCING the homestead exemptions for qualifying seniors and ON JULY 1, 2022 THROUGH FISCAL YEAR ENDING JULY 1, 2027, THE STATE SHALL BE AUTHORIZED TO RETAIN 39-28.8-204. Revenue and spending limitations. (1) disabled veterans? Notwithstanding any limitations on revenue, spending,. or appropriations contained in section 20 of article X of the state constitution or any other provision of AND SPEND UP TO 25 MILLION PER YEAR IN REVENUE FOR WARRANTS OTHERWISE AUTHORIZED UNDER THIS SECTION. COLORADO TATE OF 2021 Statewide Ballot Issues Pg 4 1876 to the old age pension fund created in section 1 of law, any revenues generated by the retail marijuana Text of Measure: article XXIV of the state constitution in accordance sales tax imposed pursuant to this part 2 as approved with paragraphs (a) and (f) of section 2 of article XXIVV by the voters at the statewide election in November Be it Enacted by the People of the State of Colorado: of the state constitution and thereafter are transferred 2013, may be collected and spent as voter-approved to the general fund in accordance with section 7 of revenue changes and shall not require voter approval SECTION 1. In Colorado Revised Statutes, 39-1-104 article XXIV of the state constitution. For each fiscal subsequent to the voter approval required pursuant to year in which a tax is collected pursuant to this part part 4 of this article. 2, an amount shall be appropriated or distributed from the general fund as follows: amend (1) as follows: (1) THROUGH DECEMBER 31, 2021 the valuation for (2) NOTWITHSTANDING ANY LIMITATIONS ON REVENUE, assessment of all taxable property in the state shall be twenty-nine percent, AND BEGINNING ON JANUARY SPENDING, OR APPROPRIATIONS CONTAINED IN 1, 2022 THE VALUATION FOR ASSESSMENT OF ALL (a)(I) Before July 1, 2017, an amount equal to fifteen SECTION 20 OF ARTICLE X OF THE STATE CONSTITUTION percent of the gross retail marijuana sales tax revenue collected by the department is apportioned to local governments. On and after July 1, 2017, an amount equal to ten percent of the gross retail marijuana sales (D), AS APPROVED BY THE VOTERS AT THE STATEWIDE tax revenue collected by the department, EXCLUDING ELECTION IN NOVEMBER 2021, MAY BE COLLECTED AND TAXABLE PROPERTY IN THE STATE SHALL BE TWENTY-SIX OR ANY OTHER PROVISION OF LAW, ANY REVENUES AND FOUR-TENTHS PERCENT of the actual value thereof GENERATED BY THE ADDITIONAL RETAIL MARIJUANA SALES TAX IMPOSED BY SECTION 39-28.8-202(1(a)(1) as determined by the assessor and the administrator in the manner prescribed by law, and such percentage shall be uniformly applied, without exception, to the actual value, so determined, of the various classes and subclasses of real and personal property located within the territorial limits of the authority levying a property tax, and all property taxes shall be levied against the aggregate valuation for assessment resulting from the application of such percentage. This subsection (1) REVENUE ATTRIBUTABLE TO THE ADDITIONAL TAX SPENT AS A VOTER-APPROVED REVENUE CHANGE. IMPOSED BY SECTION 39-28.8-202(1)(a)(1)(D), is apportioned to local governments. The city or town share is apportioned according to the percentage that retail marijuana sales tax revenue collected by the department within the boundaries of the city or town bear to the total retail marijuana sales tax The ballot tide below is a summary drafrted by the shall not apply to residential real property, producing revenue collected by the department. The county professional staff of the offices of the secretary of mines, and lands or leaseholds producing oil or gas. share is apportioned according to the percentage general assembly for ballot purposes only. The ballot SECTION 2. In Colorado Revised Statutes, 39-1- that retail marijuana sales tax revenue collected by itle will not appear in the Colorado Revised Statutes. 104.2 amend (3)(q) as follows: the department in the unincorporated area of the county bear to total retail marijuana sales tax revenue collected by the department. Proposition 120 Property Tax Assessment Rate Reduction state, the attorney general, and the legal staff for the The text of the measure that will appear in the Colorado Revised Statutes below was drafted by the 39-1-104.2. Adjustment of residential rate- proponents of the initiative. The initiated measure is legislative declaration - definitions. (b)XL.5) On and after July 1, 2018, of the ninety percent included on the ballot as a proposed change to current of the gross retail marijuana sales tax revenue in law because the proponents gathered the required (3) (q) The ratio of valuation for assessment for the general fund remaining after the allocation to amount of petition signatures. local governments required by subsection (1)(a)(1) Ballot Title: of this section is made, AND EXCLUDING REVENUE residential real property is 7.15 percent of actual value for property tax years commencing on or after January 1, 2019 and 6.5 PERCENT OF THE ACTUAL VALUE FOR PROPERTY TAX COMMENCING JANUARY 1, 2022, until Shall there be a change to the Colorado Revised the next property tax year that the general assembly Statutes concerming property tax reductions, and, adjusts the ratio of valuation for assessment for ATTRIBUTABLE TO THE ADDITIONAL TAX IMPOSED BY SECTION 39-28.8-202(1)(aXI)(D). the state treasurer shall retain fifteen and fifty-six one-hundredths percent in connection therewith, reducing property tax residential real property. in the general fund for use for any lawful purpose and revenue by an estimated $1.03 billion in 2023 and shall transfer from the general fund: by comparable amounts thereafter by reducing the SECTION 3. In Colorado Revised Statutes, 39-3-207 residential property tax assessment rate from 7.15% add (6) as follows: to 6.5% and reducing the property tax assessment rate for all other property, excluding producing mines and lands or leaseholds producing oil or gas, from 29% to reimbursement to local governmental entities. 26.4% and allowing the state to annually retain and (c) ON AND AFTER JANUARY 1, 2022, THE STATE TREASURER SHALL TRANSFER MONTHLY FROM THE 39-3-207. Reporting of exemptions- GENERAL FUND TO THE LEARNING ENRICHMENT AND ACADEMIC PROGRESS FUND CREATED BY SECTION DEPARTMENT ATTRIBUTABLE TO THE ADDITIONAL TAX Spend up to $25 million of excess state revenue, if any, (0) FOR THE PURPOSE OF OFF-SETTING LOST REVENUE for state fiscal years 2022-23 through 2026-27 as a 22-86.1-106 ALL REVENUE COLLECTED BY THE RESULTING FROM A REDUCTION IN PROPERTY TAX IMPOSED BY SECTION 39-28.8-202(1(a)(1)(D). AND TO FUND STATE REIMBURSEMENTS TO LOCAL voter-approved revenue change to offset lost revenue GOVERNMENT ENTITIES FOR THE APPLICATION OF THE SECTION 5. In Colorado Revised Statutes, amend resulting from the property tax rate reductions and to 39-28.8-204 as follows: reimburse local governments for revenue lost due to HOMESTEAD EXEMPTION, IN FISCAL YEAR COMMENCING the homestead exemptions for qualifying seniors and ON JULY 1, 2022 THROUGH FISCAL YEAR ENDING JULY 1, 2027, THE STATE SHALL BE AUTHORIZED TO RETAIN 39-28.8-204. Revenue and spending limitations. (1) disabled veterans? Notwithstanding any limitations on revenue, spending,. or appropriations contained in section 20 of article X of the state constitution or any other provision of AND SPEND UP TO 25 MILLION PER YEAR IN REVENUE FOR WARRANTS OTHERWISE AUTHORIZED UNDER THIS SECTION. COLORADO TATE OF