Advertisement

-

Published Date

December 22, 2023This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

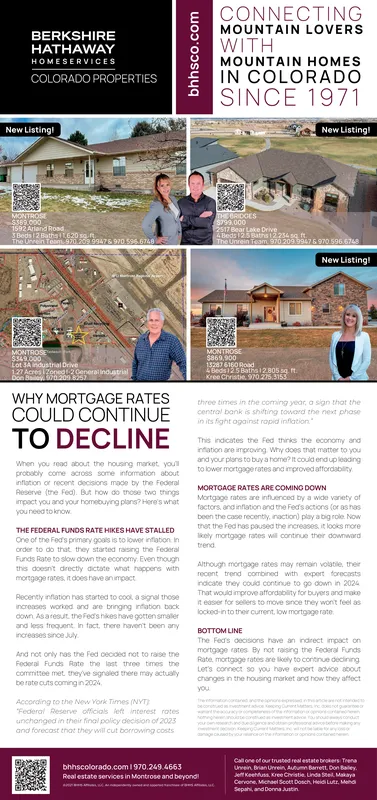

BERKSHIRE HATHAWAY HOMESERVICES COLORADO PROPERTIES New Listing! MONTROSE $369.000 1592 Arland Road Beds 12 Batha11620 The Unrein Team-970 209 9947 & 970 596 6748 MONTROSE $349,000 Lot 3A Industrial Drive 127 Acres Zoned 1-2 neranduril 2300 201 s WHY MORTGAGE RATES COULD CONTINUE TO DECLINE When you read about the housing market you'll probably come across some information about inflation or recent decisions made by the Federal Reserve (the Fed). But how do those two things impact you and your homebuying plans? Here's what you need to know THE FEDERAL FUNDS RATE HIKES HAVE STALLED One of the Fed's primary goals is to lower inflation in order to do that they started raising the Federal Funds Rate to slow down the economy. Even though this doesn't directly dictate what happens with mortgage rates, it does have an impact Recently inflation has started to cool a signal those increases worked and are bringing inflation back down As a result, the Fed's hikes have gotten smaller and less frequent. In fact, there haven't been any increases since July And not only has the Fed decided not to raise the Federal Funds Rate the last three times the committee met, they've signaled there may actually berate cuts coming in 2024 According to the New York Times (NYT) "Federal Reserve officials left interest rates unchanged in their final policy decision of 2023 and forecast that they will cut borrowing costs bhhsco.com FOCA CONNECTING MOUNTAIN LOVERS WITH MOUNTAIN HOMES IN COLORADO SINCE 1971 New Listing! THE BRIDGES $799.000 2517 Bear Lake Drive 4 Beds 12.5 Batha12.25 ft. The Unrein Team 970 209.9947 & 970 596 6748 New Listing! MONTROSE $869,900 132876160 Road Beds 125 Baths 12.805 sq.ft Kree Christie, 970 275.3155 three times in the coming year, a sign that the central bank is shifting toward the next phose in its fight against rapid inflation This indicates the Fed thinks the economy and inflation are improving Why does that matter to you and your plans to buy a home? It could end up leading to lower mortgage rates and improved affordability bhhscolorado.com 1970.249.4663 Real estate services in Montrose and beyond! MORTGAGE RATES ARE COMING DOWN Mortgage rates are influenced by a wide variety of factors and inflation and the Fed's actions (or as has been the case recently, inaction) play a big role Now that the Fed has paused the increases, it looks more ikely mortgage rates will continue their downward trend Although mortgage rates may remain volatile their recent trend combined with expert forecasts indicate they could continue to go down in 2024 That would improve affordability for buyers and make it easier for sellers to move since they won't feel as locked into their current, low mortgage rate BOTTOM LINE The Fed's decisions have an indirect impact on mortgage rates. By not raising the Federal Funds Rate, mortgage rates are likely to continue declining Let's connect so you have expert advice about changes in the housing market and now they affect. you 1 Call one of our trusted real estate brokers Trena Unrein, Brian Unrein, Autumn Barrett, Don Bailey Jeff Keeffus Kree Christie, Linda Stel, Makaya Cervone, Michael Scott Dosch, Heidi Lutr. Mend Sepahiand Donna Justin BERKSHIRE HATHAWAY HOMESERVICES COLORADO PROPERTIES New Listing ! MONTROSE $ 369.000 1592 Arland Road Beds 12 Batha11620 The Unrein Team - 970 209 9947 & 970 596 6748 MONTROSE $ 349,000 Lot 3A Industrial Drive 127 Acres Zoned 1-2 neranduril 2300 201 s WHY MORTGAGE RATES COULD CONTINUE TO DECLINE When you read about the housing market you'll probably come across some information about inflation or recent decisions made by the Federal Reserve ( the Fed ) . But how do those two things impact you and your homebuying plans ? Here's what you need to know THE FEDERAL FUNDS RATE HIKES HAVE STALLED One of the Fed's primary goals is to lower inflation in order to do that they started raising the Federal Funds Rate to slow down the economy . Even though this doesn't directly dictate what happens with mortgage rates , it does have an impact Recently inflation has started to cool a signal those increases worked and are bringing inflation back down As a result , the Fed's hikes have gotten smaller and less frequent . In fact , there haven't been any increases since July And not only has the Fed decided not to raise the Federal Funds Rate the last three times the committee met , they've signaled there may actually berate cuts coming in 2024 According to the New York Times ( NYT ) " Federal Reserve officials left interest rates unchanged in their final policy decision of 2023 and forecast that they will cut borrowing costs bhhsco.com FOCA CONNECTING MOUNTAIN LOVERS WITH MOUNTAIN HOMES IN COLORADO SINCE 1971 New Listing ! THE BRIDGES $ 799.000 2517 Bear Lake Drive 4 Beds 12.5 Batha12.25 ft . The Unrein Team 970 209.9947 & 970 596 6748 New Listing ! MONTROSE $ 869,900 132876160 Road Beds 125 Baths 12.805 sq.ft Kree Christie , 970 275.3155 three times in the coming year , a sign that the central bank is shifting toward the next phose in its fight against rapid inflation This indicates the Fed thinks the economy and inflation are improving Why does that matter to you and your plans to buy a home ? It could end up leading to lower mortgage rates and improved affordability bhhscolorado.com 1970.249.4663 Real estate services in Montrose and beyond ! MORTGAGE RATES ARE COMING DOWN Mortgage rates are influenced by a wide variety of factors and inflation and the Fed's actions ( or as has been the case recently , inaction ) play a big role Now that the Fed has paused the increases , it looks more ikely mortgage rates will continue their downward trend Although mortgage rates may remain volatile their recent trend combined with expert forecasts indicate they could continue to go down in 2024 That would improve affordability for buyers and make it easier for sellers to move since they won't feel as locked into their current , low mortgage rate BOTTOM LINE The Fed's decisions have an indirect impact on mortgage rates . By not raising the Federal Funds Rate , mortgage rates are likely to continue declining Let's connect so you have expert advice about changes in the housing market and now they affect . you 1 Call one of our trusted real estate brokers Trena Unrein , Brian Unrein , Autumn Barrett , Don Bailey Jeff Keeffus Kree Christie , Linda Stel , Makaya Cervone , Michael Scott Dosch , Heidi Lutr . Mend Sepahiand Donna Justin