Advertisement

-

Published Date

October 14, 2025This ad was originally published on this date and may contain an offer that is no longer valid. To learn more about this business and its most recent offers, click here.

Ad Text

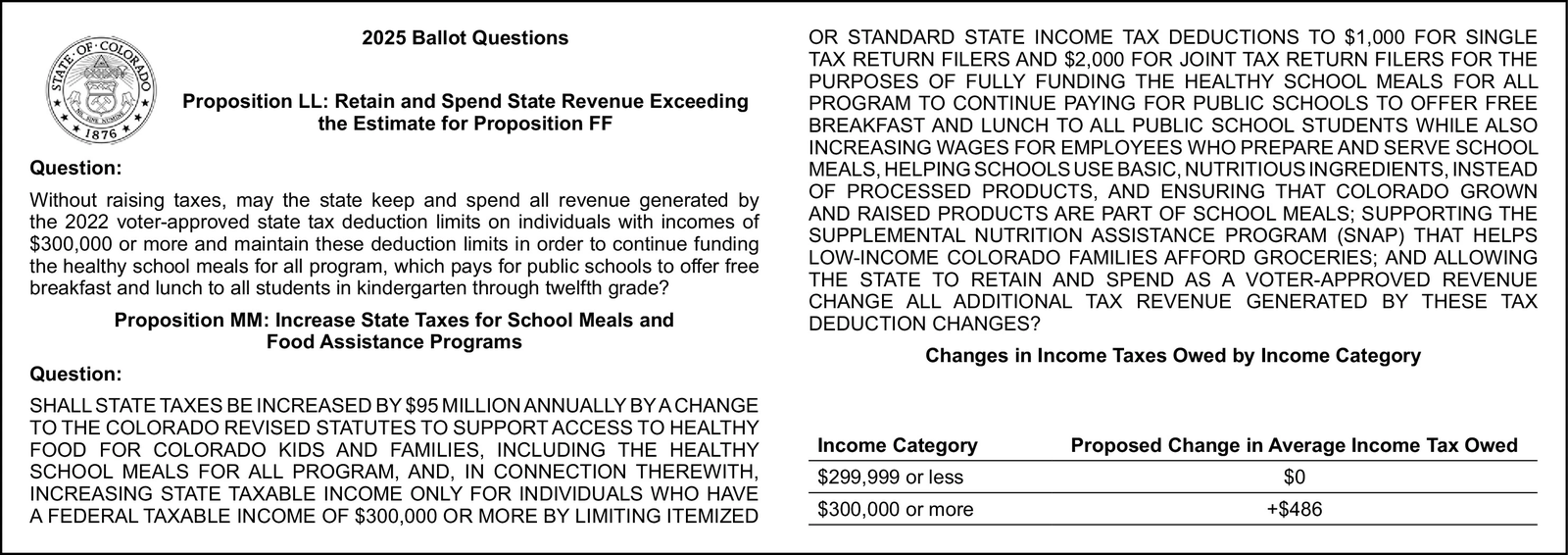

STATE OF COLORADO 1876 Question: 2025 Ballot Questions Proposition LL: Retain and Spend State Revenue Exceeding the Estimate for Proposition FF Without raising taxes, may the state keep and spend all revenue generated by the 2022 voter-approved state tax deduction limits on individuals with incomes of $300,000 or more and maintain these deduction limits in order to continue funding the healthy school meals for all program, which pays for public schools to offer free breakfast and lunch to all students in kindergarten through twelfth grade? Proposition MM: Increase State Taxes for School Meals and Question: Food Assistance Programs SHALL STATE TAXES BE INCREASED BY $95 MILLION ANNUALLY BY A CHANGE TO THE COLORADO REVISED STATUTES TO SUPPORT ACCESS TO HEALTHY FOOD FOR COLORADO KIDS AND FAMILIES, INCLUDING THE HEALTHY SCHOOL MEALS FOR ALL PROGRAM, AND, IN CONNECTION THEREWITH, INCREASING STATE TAXABLE INCOME ONLY FOR INDIVIDUALS WHO HAVE A FEDERAL TAXABLE INCOME OF $300,000 OR MORE BY LIMITING ITEMIZED OR STANDARD STATE INCOME TAX DEDUCTIONS TO $1,000 FOR SINGLE TAX RETURN FILERS AND $2,000 FOR JOINT TAX RETURN FILERS FOR THE PURPOSES OF FULLY FUNDING THE HEALTHY SCHOOL MEALS FOR ALL PROGRAM TO CONTINUE PAYING FOR PUBLIC SCHOOLS TO OFFER FREE BREAKFAST AND LUNCH TO ALL PUBLIC SCHOOL STUDENTS WHILE ALSO INCREASING WAGES FOR EMPLOYEES WHO PREPARE AND SERVE SCHOOL MEALS, HELPING SCHOOLS USE BASIC, NUTRITIOUS INGREDIENTS, INSTEAD OF PROCESSED PRODUCTS, AND ENSURING THAT COLORADO GROWN AND RAISED PRODUCTS ARE PART OF SCHOOL MEALS; SUPPORTING THE SUPPLEMENTAL NUTRITION ASSISTANCE PROGRAM (SNAP) THAT HELPS LOW-INCOME COLORADO FAMILIES AFFORD GROCERIES; AND ALLOWING THE STATE TO RETAIN AND SPEND AS A VOTER-APPROVED REVENUE CHANGE ALL ADDITIONAL TAX REVENUE GENERATED BY THESE TAX DEDUCTION CHANGES? Changes in Income Taxes Owed by Income Category Income Category $299,999 or less $300,000 or more Proposed Change in Average Income Tax Owed $0 +$486 STATE OF COLORADO 1876 Question : 2025 Ballot Questions Proposition LL : Retain and Spend State Revenue Exceeding the Estimate for Proposition FF Without raising taxes , may the state keep and spend all revenue generated by the 2022 voter - approved state tax deduction limits on individuals with incomes of $ 300,000 or more and maintain these deduction limits in order to continue funding the healthy school meals for all program , which pays for public schools to offer free breakfast and lunch to all students in kindergarten through twelfth grade ? Proposition MM : Increase State Taxes for School Meals and Question : Food Assistance Programs SHALL STATE TAXES BE INCREASED BY $ 95 MILLION ANNUALLY BY A CHANGE TO THE COLORADO REVISED STATUTES TO SUPPORT ACCESS TO HEALTHY FOOD FOR COLORADO KIDS AND FAMILIES , INCLUDING THE HEALTHY SCHOOL MEALS FOR ALL PROGRAM , AND , IN CONNECTION THEREWITH , INCREASING STATE TAXABLE INCOME ONLY FOR INDIVIDUALS WHO HAVE A FEDERAL TAXABLE INCOME OF $ 300,000 OR MORE BY LIMITING ITEMIZED OR STANDARD STATE INCOME TAX DEDUCTIONS TO $ 1,000 FOR SINGLE TAX RETURN FILERS AND $ 2,000 FOR JOINT TAX RETURN FILERS FOR THE PURPOSES OF FULLY FUNDING THE HEALTHY SCHOOL MEALS FOR ALL PROGRAM TO CONTINUE PAYING FOR PUBLIC SCHOOLS TO OFFER FREE BREAKFAST AND LUNCH TO ALL PUBLIC SCHOOL STUDENTS WHILE ALSO INCREASING WAGES FOR EMPLOYEES WHO PREPARE AND SERVE SCHOOL MEALS , HELPING SCHOOLS USE BASIC , NUTRITIOUS INGREDIENTS , INSTEAD OF PROCESSED PRODUCTS , AND ENSURING THAT COLORADO GROWN AND RAISED PRODUCTS ARE PART OF SCHOOL MEALS ; SUPPORTING THE SUPPLEMENTAL NUTRITION ASSISTANCE PROGRAM ( SNAP ) THAT HELPS LOW - INCOME COLORADO FAMILIES AFFORD GROCERIES ; AND ALLOWING THE STATE TO RETAIN AND SPEND AS A VOTER - APPROVED REVENUE CHANGE ALL ADDITIONAL TAX REVENUE GENERATED BY THESE TAX DEDUCTION CHANGES ? Changes in Income Taxes Owed by Income Category Income Category $ 299,999 or less $ 300,000 or more Proposed Change in Average Income Tax Owed $ 0 + $ 486